how long can the irs legally collect back taxes

After that the debt is wiped clean from its books and the IRS writes it off. There is a 10-year statute of limitations on the IRS for collecting taxes.

Irs Crypto Crackdown Likely To Be Delayed Giving Tax Cheats A Reprieve Bloomberg

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. You can find answers.

100 Money Back Guarantee. Assessment is not necessarily the reporting date or the date on. Ad Honest Fast Help - A BBB Rated.

The IRS 10 year window to collect. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. This means that under normal circumstances the IRS can no longer pursue collections action against you if.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. Please dont hesitate to contact us with any questions you may have. Ad Owe The IRS.

How Long Can the IRS Collect Back Taxes. The Internal Revenue Service IRS has a 10 year statute of limitations for which they can collect back taxes. The Internal Revenue Service the IRS has ten years to collect any debt.

6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual. Failing to pay your taxes may lead to IRS collection activities. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

After that the debt is wiped clean from its books and the IRS. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. The tax assessment date can change.

This means that the maximum period of time the IRS can legally collect on back. Get Your Free Consultation. These records will be handy should you ever face an IRS.

Make IRSgov your first stop for your tax needs. Ad Find Out Free If Qualified To Reduce Or Eliminate IRS Debt With Fresh Start Program. As stated before the IRS can legally collect.

With the Interactive Tax Assistant at IRSgovITA. Learn more about the IRS Statute of Limitations here. Ad Use our tax forgiveness calculator to estimate potential relief available.

Keep all employee records including in-home employees for at least 4 years after the date the payroll taxes become due or paid. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. But the agency cant chase you forever.

This is known as the statute of limitations. After the IRS determines that additional taxes are. See if You Qualify For Tax Payer Relief Program.

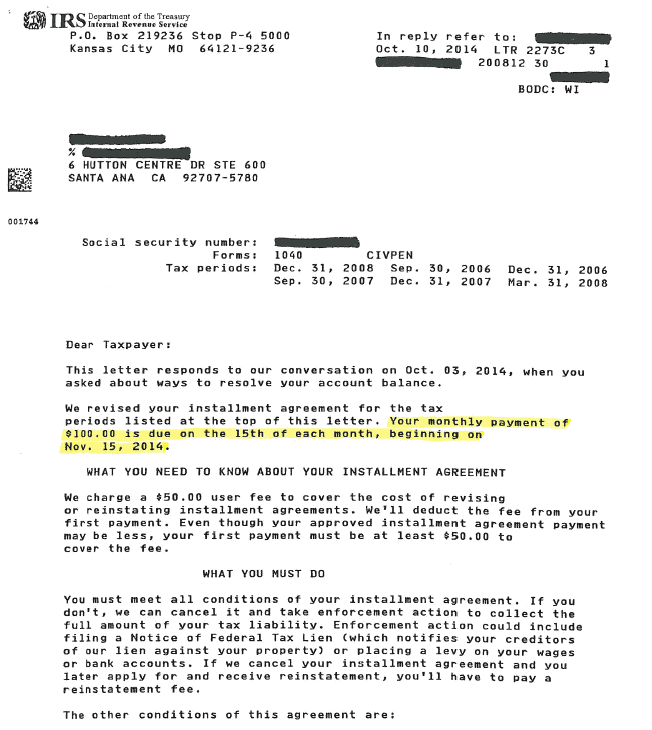

That statute runs from the date of the assessment. Once a lien arises the IRS generally cant release the lien until the tax penalty interest and recording fees are paid in full or until the IRS may no longer legally collect the tax. The IRS generally has 10 years from the date of assessment to collect on a balance due.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Take 1 Min Find Out Now. According to Internal Revenue Code Sec.

How far back can the IRS collect unpaid taxes. The collection statute expiration ends the. After that the debt is wiped clean from its books and the IRS writes it off.

Ad Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. This means that the IRS has 10 years after.

You May Qualify For An IRS Hardship Program If You Live In New Jersey. Take 60 Seconds To See If You Qualify For A Free Expert Tax Relief Consultation. Ad Use our tax forgiveness calculator to estimate potential relief available.

GET PEACE OF MIND. How long can the IRS collect back taxes. Avoid penalties and interest by getting your taxes forgiven today.

As already hinted at the statute of limitations on IRS debt is 10 years. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

How Far Back Can The Irs Collect Unfiled Taxes

Will The Inflation Reduction Act Increase Irs Tax Audits

Will The Inflation Reduction Act Increase Irs Tax Audits

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

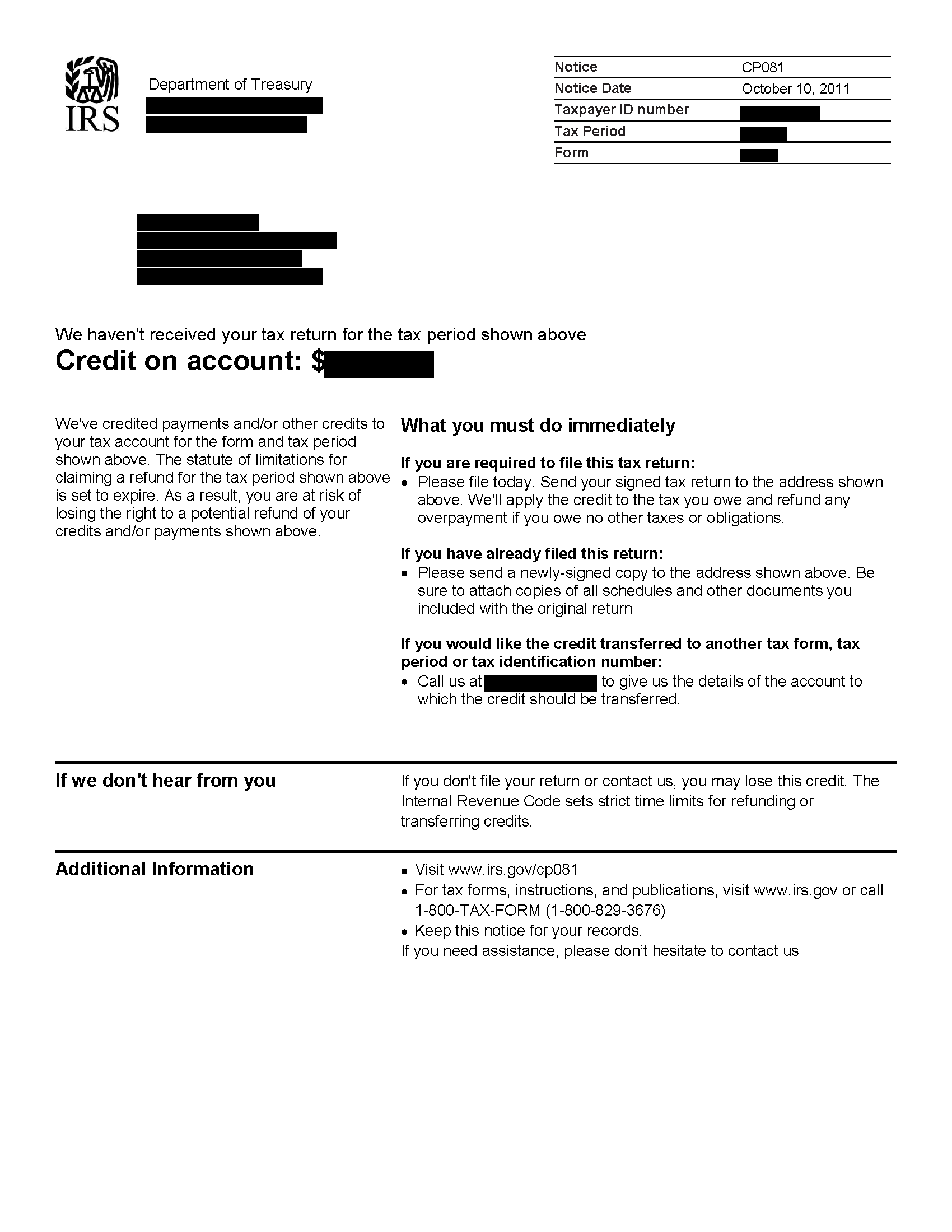

Irs Notice Cp81 Tax Return Not Received Credit On Account H R Block

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Are There Statute Of Limitations For Irs Collections Brotman Law

Irs Tax Letters Explained Landmark Tax Group

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

Who Goes To Prison For Tax Evasion H R Block

Here S The Average Irs Tax Refund Amount By State

Schedule K 1 Federal Tax Form What Is It And Who Is It For

2022 Irs Tax Refund Dates When To Expect Your Refund

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Tax Refunds Will You Pay Taxes On Your Social Security Payments Marca

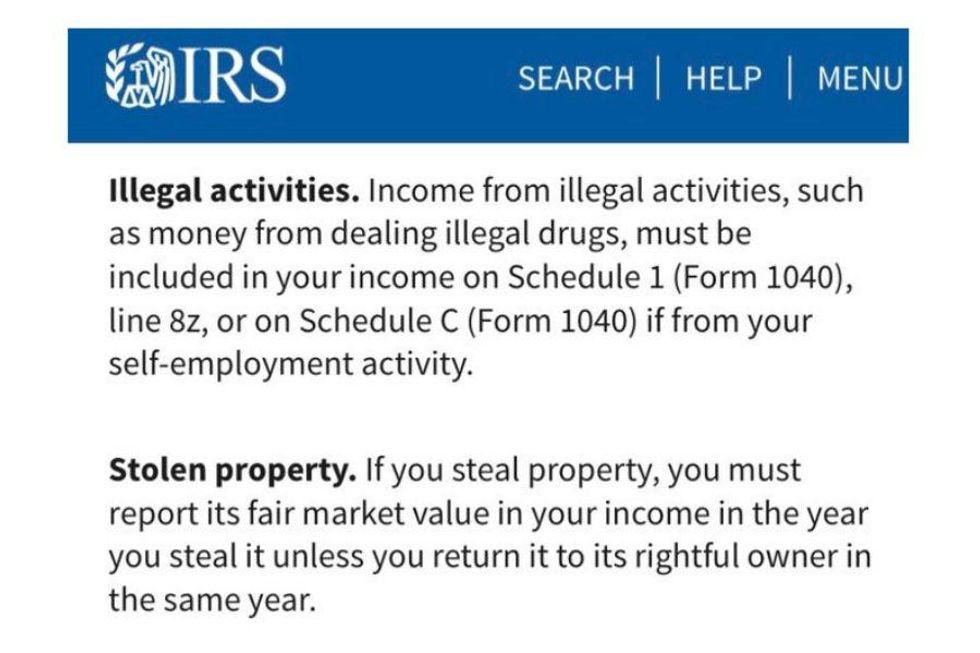

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy